Page 3 - index

P. 3

3

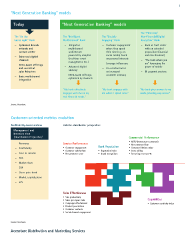

“Next Generation Banking” models

Today “Next Generation Banking” models

The “Financial/

The “do the The “Intelligent The “Socially Non-Financial Digital

basics right” Bank Multichannel” Bank Engaging” Bank Ecosystem” Bank

− Optimized branch − Integrated − Customer engagement − Bank as trust center

network and multichannel where they spend with an extended

contact center architecture, their time (e.g. on proposition (financial

− Enhanced digital powered by analytics social media) based and non-financial)

channels (real-time event on personal interests − “The bank where you

management, etc.)

− Need-based offerings − Leverage influencers are” leveraging the

and consistent − Advanced digital − Co-creation based power of mobile

sales behaviors advisory on increased − M-payment services

− Basic multichannel − Need-based offerings customer intimacy

integration optimized by channels

“My bank effectively “My bank engages with “My bank gives answers to my

engages with me on my me where I spend time.” needs, providing easy access.”

real financial needs.”

Source: Accenture

Customer-oriented metrics evolution

Profitability-based metrics Holistic stakeholder perspective

Management and

investors view

(Shareholders Perspective) Commercial Performance

• ARPU (revenue per customer)

− Revenues Service Performance • Net customer flow

− Profitability • Customer engagement Bank Reputation • Customer lifetime value

• Customer satisfaction • Reputation index • Cross selling

− Cost-to-income • Net promoter score • Brand recognition • Recurring revenues %

− ROE

− Market share

− EVA

− Share price trend

− Market capitalization

− EPS

Sales Effectiveness

• Sale productivity

• Sales per square mile Capabilities

• Campaign effectiveness • Customer centricity index

• Product penetration

• Customer contacts

• Social channel engagement

Source: Accenture

Accenture Distribution and Marketing Services

“Next Generation Banking” models

Today “Next Generation Banking” models

The “Financial/

The “do the The “Intelligent The “Socially Non-Financial Digital

basics right” Bank Multichannel” Bank Engaging” Bank Ecosystem” Bank

− Optimized branch − Integrated − Customer engagement − Bank as trust center

network and multichannel where they spend with an extended

contact center architecture, their time (e.g. on proposition (financial

− Enhanced digital powered by analytics social media) based and non-financial)

channels (real-time event on personal interests − “The bank where you

management, etc.)

− Need-based offerings − Leverage influencers are” leveraging the

and consistent − Advanced digital − Co-creation based power of mobile

sales behaviors advisory on increased − M-payment services

− Basic multichannel − Need-based offerings customer intimacy

integration optimized by channels

“My bank effectively “My bank engages with “My bank gives answers to my

engages with me on my me where I spend time.” needs, providing easy access.”

real financial needs.”

Source: Accenture

Customer-oriented metrics evolution

Profitability-based metrics Holistic stakeholder perspective

Management and

investors view

(Shareholders Perspective) Commercial Performance

• ARPU (revenue per customer)

− Revenues Service Performance • Net customer flow

− Profitability • Customer engagement Bank Reputation • Customer lifetime value

• Customer satisfaction • Reputation index • Cross selling

− Cost-to-income • Net promoter score • Brand recognition • Recurring revenues %

− ROE

− Market share

− EVA

− Share price trend

− Market capitalization

− EPS

Sales Effectiveness

• Sale productivity

• Sales per square mile Capabilities

• Campaign effectiveness • Customer centricity index

• Product penetration

• Customer contacts

• Social channel engagement

Source: Accenture

Accenture Distribution and Marketing Services